This blog post expands the article about diversification within a portfolio. The former demonstrated the diversifying effect of investing in different asset classes. This article describes those asset classes in more detail: what they are, their properties, and their behavior in different economic conditions.

As a short recap: we, as investors, should put our eggs in many different baskets. The selection of other asset classes and the allocation of our money into those asset classes is more important than the questions of when to buy (timing the market won’t work 99% of the time) and deciding what stocks exactly we buy. The mechanism behind diversification is that different asset classes react differently to changing economic conditions.

What are asset classes?

A group of investments with similar characteristics is called an asset class. This means the members of an asset class share similar behavior, are traded on the same marketplaces, have a comparable financial structure, and are subject to similar regulations.

While assets within one asset class behave in tandem (as we showed in the article about diversification), different asset classes show different behavior among each other- the basis for diversification.

Don’t confuse asset class with investment vehicle: ETFs, for example, are investment vehicles and can contain everything: assets from a single asset class and even mix assets of different classes.

Usually, assets within an asset class can be further categorized, for example, into sectors, regions, or maturity dates (for bonds).

Taxononomy of asset classes

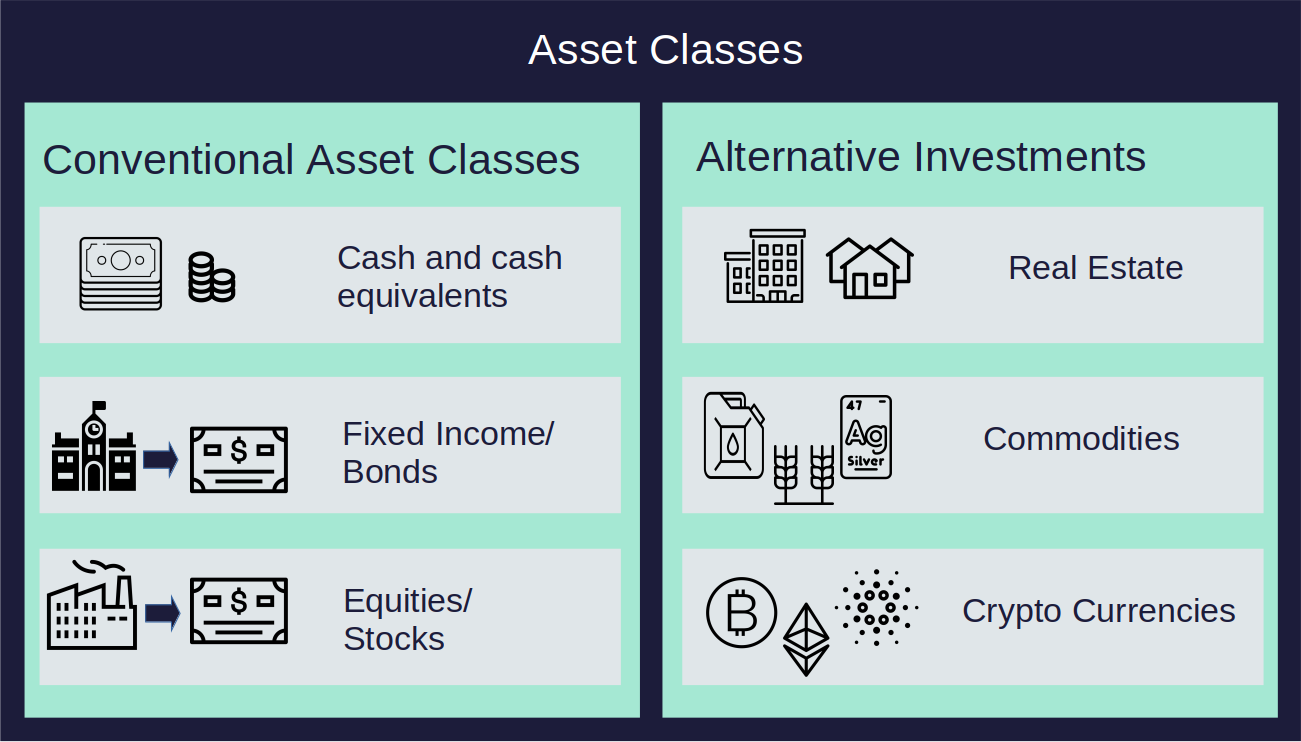

There are many ways to structure assets into classes. We use a taxonomy that reflects what’s accessible to us as retail investors, as simple as possible but still as distinguishable as necessary.

Conventional asset classes

We distinguish the following conventional asset classes:

Cash and cash equivalents: These are highly liquid assets, including savings accounts, money market funds, and short-term certificates of deposit (CDs).

Fixed income: These are investments that provide a fixed income stream, such as bonds and other debt securities.

Equities: These are stock investments representing ownership in a company.

Alternative investments:

The usual textbook definition defines Alternative Investments as assets that are not part of either cash, fixed income, or equities. Alternative investments include Commodities, Real Estate, and Crypto. For our taxonomy, we’ll have those as separate asset classes:

Real estate: This asset class includes investments in physical property, such as residential or commercial properties.

Commodities: These are raw materials that are traded on markets, such as gold, oil, and agricultural products

Crypto Currencies: Digital assets that use cryptography for secure transactions and are traded on online exchanges

On the other hand, Alternative Investments also include a broad spectrum of hedge funds, private equity, and venture capital. As those assets are not as easily accessible for retail investors, we will leave them out for this overview.

Asset Classes and their characteristics

The following paragraphs summarize those asset classes and give a broad overview of their characteristics and behavior in different economic conditions. We will have a look at their volatilities, their general behavior in growing or shrinking economies, and the sensitivity to rising or decreasing interest rates.

This table gives you the main characteristics of all asset classes at a glance. However, economy is not an exact science. Between black and white, there are many shades. Think of this table as a rule of thumb, a guideline when constructing your portfolio.

Cash and Cash equivalents

This asset class consists of highly liquid assets, including savings accounts, money market funds, and short-term certificates of deposit (CDs). Highly liquid in this context means these assets can be sold or traded quickly, with minimal impact on the price.

The value of cash and cash equivalents is relatively invariant to growing or shrinking economies, as they are not directly tied to the performance of specific companies or sectors.

However, changes in interest rates may affect the returns on cash and cash equivalents. When interest rates rise, the returns on cash and cash equivalents may also increase as financial institutions offer higher rates to attract depositors. This can make cash and cash equivalents more attractive to investors looking for a safe place to hold their money.

Vice versa: with falling interest rates, returns on cash and cash equivalents may also decrease. This can make cash and cash equivalents less attractive to investors, as they can earn higher returns by investing in other asset classes, such as equities or fixed income.

It is not possible to give an indication for volatility- this very much depends on the currency of your home country and how it changes w.r.t to other currencies.

Fixed Income

Fixed income refers to investments that provide a regular return on interest. These investments are called “fixed” because the return is predetermined and does not vary. Fixed-income investments are typically issued by governments or companies and are backed by the issuer’s creditworthiness. The most prominent examples are bonds.

Fixed-income investments can offer a stable source of income and are a good option for investors looking to preserve capital and generate a steady income stream. They can also be an excellent way to diversify a portfolio and reduce risk by providing a balance to more volatile assets such as stocks.

During periods of economic contraction, or a shrinking economy, fixed-income investments may perform well. This is because fixed-income investments, such as bonds and other debt securities, are generally considered safe and are less sensitive to economic downturns than other asset classes, such as equities.

The value of fixed-income investments, such as bonds and other debt securities, may be affected by changes in interest rates. When interest rates fall, the value of existing fixed-income investments increases, as fixed-income investments offer a higher yield than newer investments issued at lower interest rates. This can lead to higher returns for investors.

Bonds are generally considered a less volatile asset class than stocks and commodities, as they are issued by governments or companies and backed by the issuer’s creditworthiness.

Equities/ Stocks

Equities, also known as stocks or shares, are securities that represent ownership in a company. By buying equities of a company, we become shareholders and are entitled to a share of the company’s profits and assets. Equities are a good investment option for investors looking to earn higher returns over the long term. They also offer the opportunity to receive dividends: payments made to shareholders from the company’s profits.

During economic growth, investors may be willing to take more risks and invest in equities, as they may be more confident in the prospects for future growth. This can also contribute to higher stock prices. During periods of a shrinking economy, investors may also be more risk-averse and less willing to invest in equities, as they may be less confident in the prospects for future growth. This can also contribute to lower stock prices.

The relationship between equities, or stocks, and interest rates is complex and depends on various factors, including economic conditions, company-specific factors, and market trends. Generally speaking, falling interest rates positively impact equities: borrowing money becomes cheaper for companies (more investments!) and individuals (increase in demand for goods and services!). Rising interest rates have the opposite effect. Also, with rising rates, new fixed-income securities become more attractive, resulting in less demand for equities.

There are several ways that investors can invest in equity:

- Individual stocks: We can buy shares of individual companies and hold them in their investment portfolio

- Mutual funds: Investors can purchase shares in a mutual fund that invests in a diversified portfolio of stocks

- Exchange-traded funds (ETFs): Purchase shares in an ETF that tracks a basket of stocks or market indices like the S&P 500.

Stocks are generally considered a highly volatile asset class, as their prices fluctuate significantly based on various factors, including economic conditions, company performance, and market sentiment..

Real Estate

Real estate is an asset class that refers to the ownership of land, buildings, and any natural resources on/in the ground. There are several ways that investors can participate in the real estate market:

- Direct ownership: Investors can purchase a property, rent it out to tenants, or sell it later.

- Real estate investment trusts (REITs): Investors can purchase shares in a REIT, a company that owns and manages a portfolio of properties- offering the opportunity for diversification within this asset class. REITs are traded on stock exchanges.

- Crowdfunding: Investors can contribute money to a real estate crowdfunding platform, which pools funds from multiple investors to finance the purchase of a property.

- Real estate mutual funds: Investors can purchase shares in a mutual fund that invests in a diversified portfolio of real estate assets.

The state of the economy can significantly impact the real estate market. A growing economy can increase demand for housing and lead to rising prices, while a shrinking economy can decrease demand and lead to falling prices. Employment, disposable income, and interest rates can also influence the relationship between the economy and the real estate market.

Interest rates can significantly impact the real estate market. When interest rates are low, it becomes more affordable for buyers to borrow money and purchase a property, increasing demand for real estate and raising prices. Conversely, when interest rates are high, it becomes more expensive for buyers to borrow money, decreasing demand for real estate and leading to falling prices.

Real estate can be a less volatile asset class than stocks and commodities, as property value tends to appreciate over the long term. However, economic and market conditions can still affect real estate prices.

Commodities

Commodities are physical goods traded on financial markets and used to produce other goods or services. The price of commodities can be influenced by various factors, including supply and demand, the state of the economy, and geopolitical events.

The state of the economy can impact the demand for and prices of commodities. When the economy is strong and growing, there may be an increase in demand for goods and services, leading to higher prices for resources needed to create them. Conversely, when the economy is weak and shrinking, there may be a decrease in demand for these goods and services, which can result in lower prices for commodities.

Interest rates can also impact the demand for and prices of commodities. It is expensive for businesses and consumers to borrow money during high-interest phases. This decreases the demand for the goods and services that commodities are used to produce, resulting in lower prices for commodities. When interest rates are lower, borrowing becomes less expensive for businesses and consumers, increasing demand for these goods and services and leading to higher prices for commodities.

However, it’s important to note that the relationship between interest rates and commodities is complex and can vary significantly depending on the specific commodity and the underlying market conditions. Some commodities may be more sensitive to changes in interest rates, while others may not be as affected.

For example, some commodities, such as precious metals, may be seen as a safe haven assets and may actually increase in value during times of economic uncertainty or rising interest rates. Other commodities, such as oil, may be more sensitive to changes in interest rates and may experience more dramatic price fluctuations.

There are several ways how investors can invest in commodities:

- Physical ownership: Investors can purchase physical commodities, such as gold or oil, and hold them in their possession or store them securely.

- Futures contracts: Buy or sell a contract to purchase or sell a specific commodity. The contract is based on a predetermined price at a future date

- Exchange-traded funds (ETFs): invest in ETFs tracking baskets of commodities or a specific commodity, such as oil or gold

- Mutual funds: Purchase shares in a mutual fund that invests in a diversified portfolio of commodities.

In terms of volatility, commodities are considered very volatile, as their prices are influenced by supply and demand and economic and geopolitical events.

Crypto Currencies

Cryptocurrencies are digital assets utilizing cryptography for secure transactions and are traded on online exchanges. They can be considered an alternative asset class, as they are not traditional assets such as stocks, bonds, and cash.

Cryptocurrencies have recently gained popularity due to their decentralized nature and the potential for high returns. However, they are also a highly speculative and volatile asset class, as their prices fluctuate significantly over short periods.

As Crypto Currencies are still in their infancy, it is too early to derive their relationship and reaction to changing economic conditions. As of late 2022, Crypto as an asset class is a proxy for overall liquidity and risk appetite, very sensitive to central banks’ policies.

Lagging regulatory policies adds another risk to Crypto investors. The demise of large Crypto institutions and the partial bans imposed by some countries are clear signs that this part of the financial markets still needs to mature.

If you remember our coin analogy from one of our past articles: if volatility is the coin- risk and reward are its sides.

If you have additional questions or feedback, please leave a comment or drop a mail to feedback@6xfreedom.com