In one of our last articles, we explained the benefits of a diversified portfolio and why it makes perfect sense to own different assets across different asset classes. In this article about Portfolio Construction, we go one step further and look at how to build a portfolio that caters to your personal needs. We will describe the necessary steps as easily as possible and at the same time as scientific as necessary. The goal is to provide guidelines you can apply to your situation.

Risk Profile

The first question we need to answer is our risk profile. There is a measure for the swings in our portfolio and its Ups and downs: volatility (there are more precise academic definitions here, we try to keep things understandable). In general: the more volatile an asset/a portfolio, the larger the swings in both directions. So, if volatility is the coin, risk and rewards are its sides. The larger the swings, the more risk tolerance is needed; at the same time, this tolerance has potentially higher rewards.

The ability and willingness to bear financial risks are very individual and depend on many factors. Besides your desire and ability to stomach deep red numbers in your portfolio, your time horizon also plays an important role: do you need the money in your portfolio in a foreseeable time frame? What is your age/ when do you plan to retire? Is the money in your portfolio everything you have or a fraction of your net worth? How much money do you earn through regular income streams? The answers to those questions are very individual, and results from different people will span a large spectrum.

To give you a kind of a guideline, we define two different baskets for risk—one basket for low-risk investments, characterized by low volatility and resulting in lower growth. The second one will include higher-risk assets that show higher volatility, resulting in more significant swings both to the up-and downside, promising higher growth as a premium for risk-taking.

With these two baskets, let’s define three exemplary portfolios.

Archetype portfolios

These three portfolios are meant to serve as a starting point for your portfolio. The percentages and exact composition can and should be altered to your taste. There is a full spectrum of possible portfolios in between. Please choose one of those three as a starting point and tailor it to your needs.

The Conservative Portfolio

For risk-averse investors, we define a portfolio that aims for stability. We look for some growth to counter the devaluation by inflation, but we want to limit volatility- and accept less potential growth in return. We will put 75% of our money into the lower volatility/lower risk basket and the remaining 25% in the higher volatility/ higher risk basket.

The balanced portfolio

The second portfolio caters to investors who look for a balance between stability and growth. 50% of lower volatility/ lower risk investments provide the solid basis that holds the other 50% of higher volatility/ higher risk assets responsible for growing your wealth.

The growth-oriented portfolio

The growth-oriented portfolio focuses on higher volatility assets (75%) for investors that favor growth over stability. The combination with lower risk assets (25%) results in a portfolio subject to higher volatility and, thus, more significant swings both on the up and downside.

The volatility of Asset Classes

Now that we have an idea of the fractions of high/low volatile assets in our archetype portfolios, we have to decide which assets we will put into those baskets. For that, we need a way to measure volatility. One way to do this is by looking at the standard deviation of the asset’s historical returns. In simple terms (and in an application for investing), the standard deviation measures the range of the returns that vary around a mean value. So, a more significant standard deviation means a more extensive range of returns and, thus, higher volatility; lower values stand for smaller ranges and, therefore, lesser volatility.

When looking at the data set of the diversification article (inflation-adjusted monthly returns from 2006-2021), we get the following comparison. Note that we added two more asset classes: Cryptocurrencies and cash (we used Bitcoin and the US Dollar Index as proxies- note that since Bitcoin is a very new asset, only data from 2014-2021 was available).

On a qualitative level, we can see that some asset classes are more volatile than others.

A couple of notes to give some context to this figure. The bar for Crypto Currencies is capped in this picture- the real value is way higher (~40) and dwarfs all other asset classes. If displayed in accurate proportions, their bars wouldn’t be visible.

A proxy represents each asset class in the above’s bar chart: for example, we choose the S&P 500 for Equities, the Dow Jones Equity REIT Index (^DJR) for “Real Estate,” and so on. The numbers will change depending on what you put into that basket (and what you leave out). If you look at small-cap tech stocks, they will vary from large established blue chips. The same is true for the time frame: the above data looks at monthly returns for 2006 – 2021. Other time frames will produce different numbers.

Now we can assign asset classes to the above’s archetype portfolios “risk baskets.” We put Crypto, Equities, and Bonds into the “higher risk/ higher growth” basket and all other asset classes into the “lower risk/ lower growth” basket.

Archetype portfolios with asset allocation

Let’s fill up the risk baskets with specific allocations! We have already reserved the available sizes for both risk baskets. When talking about the percentages of the assets, we use two different references.

First, we give you the relative percentage of an asset (for example, if the low volatility basket is 50% of the overall portfolio, and the share cash in this basket is 10%, this 10% is the relative percentage). Then we also give the absolute percentage within the portfolio (in the above’s example, the total percentage of cash would be 5%). As all percentages should be seen as a guideline and not as strict numeric targets, we also took some liberty when rounding. Decimals would only give an illusion of precision- constructing a robust portfolio is about diversifying by some basic rules and not following strict specifications.

The conservative portfolio

We reserved 75% for the lower volatility assets. So we fill this part with equal (25% relative to this basket and 19% absolute within the portfolio) parts of Cash, TIPS, REITs, and Commodities.

|

asset class |

rel

|

abs

|

| Cash | 25% | 19% |

| TIPS | 25% | 19% |

| REITS | 25% | 19% |

| Comm. | 25% | 19% |

The high volatility/high-risk basket amounts to 25% of the overall portfolio. We put equal amounts of equities and bonds into it, omitting crypto because of its volatility.

|

asset class |

rel | abs |

| Equities | 50% | 12% |

| Bonds | 50% | 12% |

| Crypto | 0% | 0% |

The standard deviation of this portfolio is 0.15. Larger than cash alone but smaller than any one of the other asset classes. Stability comes with a price: inflation-adjusted returns are limited: for each invested dollar, we would have made only $1.70 after 15 years.

The balanced portfolio

This portfolio contains equal shares of high and low-volatility assets. Within the low volatility basket, we reduce the fraction of cash to favor the other asset classes.

|

asset class |

rel | abs |

| Cash | 10% | 5% |

| TIPS | 30% | 15% |

| REITS | 30% | 15% |

| Comm. | 30% | 15% |

Within the other, more volatile half of the portfolio, we overweight equities (70% relative) and reduce the fraction of bonds (30%). Crypto, again isn’t part of this portfolio.

|

asset class |

rel | abs |

| Equities | 70% | 35% |

| Bonds | 30% | 15% |

| Crypto | 0% | 0% |

The balanced portfolio with this composition has a standard deviation of 0.27. This is well within the range of all low-volatility assets on their own but coupled with greater returns: after 15 years, each invested dollar would result in $2.40 (adjusted by inflation).

Growth-oriented portfolio

The growth-oriented portfolio puts only 25% into low-volatility assets. We reduce the amount of cash to zero while slightly increasing the other three asset classes (33%).

|

asset class |

rel | abs |

| Cash | 0% | 0% |

| TIPS | 33% | 8% |

| REITS | 33% | 8% |

| Comm. | 33% | 9% |

The riskier, larger part (75%) of this portfolio adds a small amount of crypto (too small to be annotated in the picture), reducing the relative amount of bonds even further (down to 20%).

|

asset class |

rel | abs |

| Equities | 73% | 59% |

| Bonds | 20% | 15% |

| Crypto | 7% | 1% |

Crypto has a massive influence on both returns and volatility. The given allocation’s standard deviation is 2.36- way more significant than all other asset classes except crypto. Again, higher risk leads to higher rewards: each invested dollar would have resulted in $4.48 after 15 years.

To give you a visualization of the above’s volatility/ returns numbers, here is a plot of all three portfolios’ returns throughout the years:

To give you an idea of how much a tiny fraction of a highly volatile asset (in this case, crypto) impacts the portfolio: removing the 1% crypto allocation (and adding it to equities) from the growth-oriented portfolio results in a standard deviation of only 0.4 and returns of 3x.

As you can see, one of our initial statements is very accurate: volatility is the coin, and risk and reward are its sides.

Drilling deeper

When translating the above’s allocations into real-world portfolios, we could buy ETFs that cover the broad market for each asset class. If you don’t want to spend the time and research effort for further investigation, you could be okay with that and still have a robust, tailored portfolio.

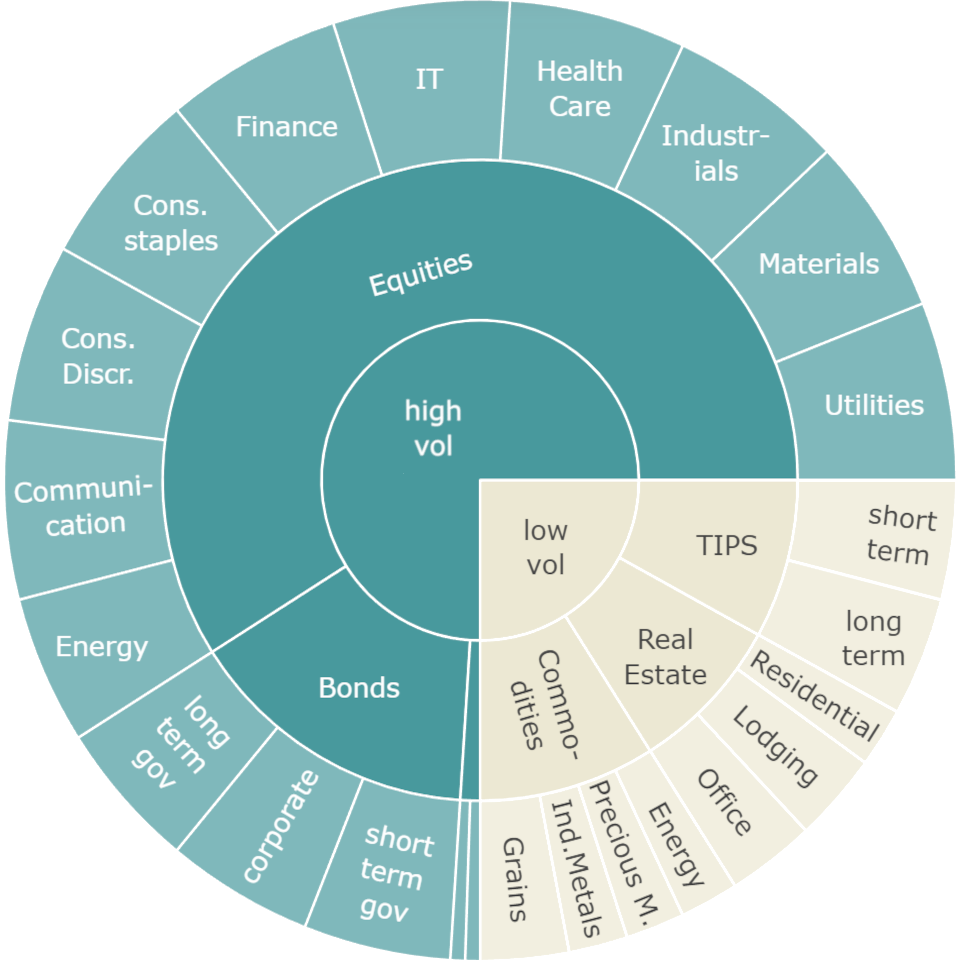

On the other hand, as we have learned in the article about diversification, asset classes can be further divided. The principles we used in this article can be applied to equities sectors, commodity groups, etc. One (out of many possible) examples is shown in the drill down of the growth-oriented portfolio in the figure below:

You can drill down asset classes (all of them or only some, like equities) and diversify by geography, time horizons, or sectors. Consistently following a similar approach: look at the volatility of the investment vehicle, and pair highly volatile with lower volatile instruments according to your willingness and ability to deal with losses.

If you have additional questions or feedback, please leave a comment or drop a mail to feedback@6xfreedom.com