How to invest? This is the third and final part of our “How to build a portfolio” mini-series of articles. As a small wrap-up: In the first article about diversification, we learned why putting all eggs in the same basket is terrible. As no one can predict the future, it is impossible to cherry-pick the only stock that will outperform everything else. We learned about different asset classes besides stocks and how we can use correlation as a tool for portfolio construction. The second article builds on top of that and introduces three archetypes of portfolios as a starting point for constructing our own. We defined asset classes as fundamental building blocks of a portfolio and learned how we could drill down each asset class into categories, industries, regions, and so on. This article will answer how we translate this strategy into actual buying assets.

Portfolio Allocation as starting point

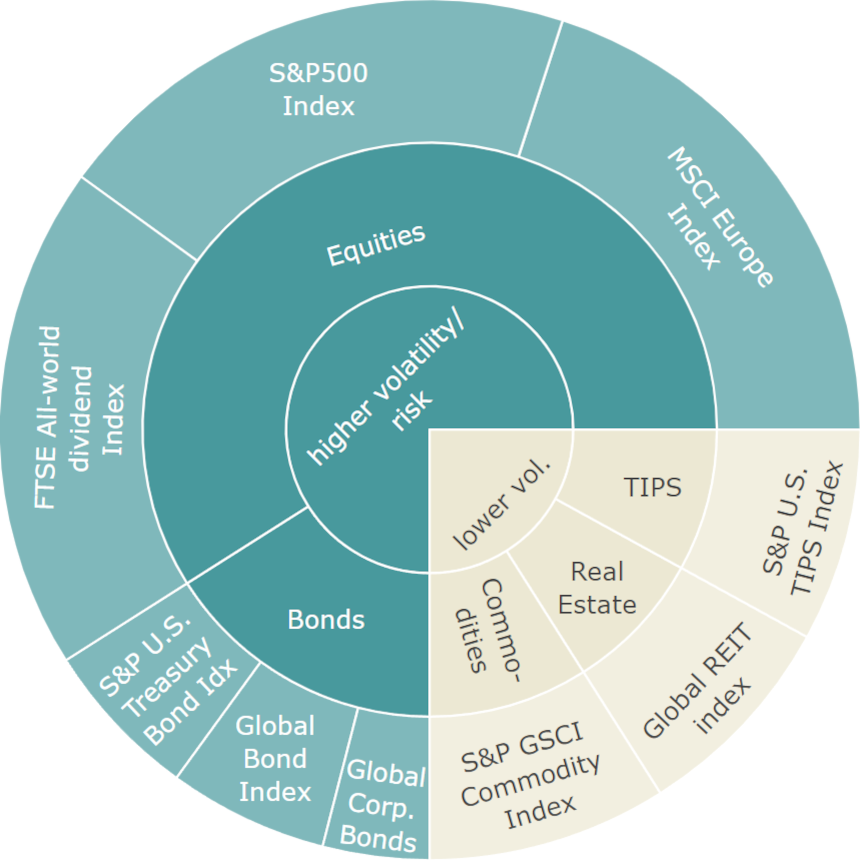

As a starting point, we chose the growth-oriented portfolio, as introduced:

We now have the task of finding investment vehicles that fit all outer segments. We could cover equities with a single ETF with a broad spectrum of global stocks. One example could resemble the MSCI World Index- and we would be done with that asset class.

On the other hand, we would limit our portfolio’s performance to MSCI World’s performance. At this point, we have the chance to alter each asset class to our personal needs and specific situation- as described in our previous article.

So let´s do an exemplary drill-down of the Growth-oriented portfolio. As a starting point, we research indices that best describe the investment philosophy we want to target with the different slices of our portfolio. We don’t want to go too deep and invest in specific stocks (however, for your portfolio, you are free to do so!). The following links provide a multitude of indices that should serve you as a good starting point (we for sure have no affiliation with any of those companies):

- https://www.msci.com/our-solutions/indexes

- https://www.londonstockexchange.com/indices?tab=ftse-indices

- https://www.spglobal.com/spdji/en/

As an example, we come up with the following allocation:

We stuck more or less to the rough allocation of the Growth-oriented Portfolio; however, we dropped Crypto. For equities, instead of investing in the MSCI World, we split this asset class into three parts:

- the US market,

- the European market,

- an index focusing on worldwide stocks that pay higher-than-average dividends.

The latter index is attractive if we later choose an ETF that does not accumulate the dividends but distributes them to its owners- creating a passive income for us.

Tailor to your own needs!

When constructing your portfolio, use the methodology, not necessarily this allocation. Tailor it to your own needs. If you want to set different priorities- go ahead! If you want to focus on growth stocks, incorporate more or other regions- feel free to do so.

You also don’t have to stick to the exact number of percentages we showed here- there is no “Perfect Allocation” as the future is, per definition, uncertain. Research has shown that having all asset classes diversified in a portfolio is more important than trying to tweak those quotas. If you already have several stocks in your portfolio (or want to buy and own specific stocks)- that’s perfectly fine! You will be fine if you diversify across equities and don’t put all your money in a particular stock.

The Math part

This part is straightforward. To this point, we did not invest a single penny. Now we translate the size of our portfolio slices into actual numbers. We take the amount of money we are willing and able to invest. Let’s say we have $50,000. We now look at the absolute percentages we allocated and multiply them with this amount. For example, the S&P500 Index has 20% of our portfolio, which translates into $50,000 * 20/100 = $10,000.

Asset Class | Asset | Percentage | Amount in $ (based on $50,000 portfolio) |

TIPS | S&P US TIPS Index | 8 % | 4,000 |

Real Estate | Global REIT Index | 8 % | 4,000 |

Commodities | S&P GSCI Commodity Index | 9 % | 4,500 |

Bonds | Global Corporate Bonds | 4 % | 2,000 |

Barclays Capital Global Aggregate Bond Index | 6 % | 3,000 | |

S&P Treasury Bond Index | 6 % | 3,000 | |

Equities | FTSE All-World Dividend Index | 19 % | 9,500 |

S&P500 Index | 20 % | 10,000 | |

MSCI Europe Index | 20% | 10,000 |

ETF primer

We have already used the abbreviation ETF several times. In case you never heard of them, it´s time to give you a short introduction. We won’t go into all details here to keep this article focused. For an in-depth article, please read the basics of ETF and how to select the best one, where we dive deeper into the nuts and bolts.

What are ETFs?

ETFs are Exchange Traded Funds. In a nutshell, they are securities that themselves invest in other securities, following specific rules. One example of those “rules” are index ETFs, which mimic indices (which can not be invested directly). By buying a single ETF replicating a whole index, we can invest in all components of this index simultaneously.

What are they suitable for?

Because of that, ETFs are a handy tool for diversification. Additionally, they allow retail investors to invest in assets that are out of reach for most of us (like commodities or most of the bonds).

As their name suggests, ETFs can be bought and sold via exchanges, and their prices are determined the same way we explained in our previous article how exchanges work.

How to choose an ETF?

As we want to keep focused on our main topic, here are some criteria we must consider when choosing an ETF to cover a specific part of our portfolio. Some of them you can read from their name, some have to be researched by the issuer’s investment documentation or ETF search websites, and some are dependent on your broker.

Tradability

Most essential (but usually the last step in the selection process): the ETF must be tradable via your broker and your exchange. The best ETF won’t help you if you can’t buy it.

Accumulating or distributing ETFs

ETFs can distribute dividends to the owners of the ETF or accumulate them and invest them further. Accumulating ETFs tend to have a better price-performance; distributing ETFs give us a nice passive income (creating a taxable event for each distribution). Usually, this property is reflected in the name of an ETF

Total Expense Ratio (TER)

As ETFs are usually very cheap, the issuing institutions still have operating costs, which must be covered. So they subtract a fee regularly. Lower TER is better

Underlying currency of the ETF

ideally, you want an ETF to be in the same money where you pay your bread. To avoid additional currency risks to your ETF’s performance, look for ETFs with the same currency as your portfolio. Many ETF providers issue their funds in different currency “flavors,” so check before buying one blindly.

A word of caution

ETF, as such, is not a “quality label.” Almost everything can be wrapped into an ETF. So it makes sense that we first consider what type of investment we want to make and then research a relevant ETF. That’s why we put this short introduction on ETFs at this -quite late- stage of our portfolio creation process.

The research part, a.k.a. “the hard work.”

It is not THAT hard, especially compared to the work you had to do to earn money in the first place. But unfortunately, we cannot do it for you- the variations of your situation and the possible limitations due to what your broker provides are endless. But on the other hand, we are here to be confident, self-reliant, and empowered to handle our investments on our own.

So, how do we do that? We need access to our broker (to check if a particular instrument is available) and a search website for ETFs: https://www.etf.com/etfanalytics/etf-finder would be a good starting point (again, we have no affiliation with this website).

Try to find ETFs that model the indices of the portfolio drill-down. We can do so by searching for the name of the index or by using the different filters of the search. Then look at your broker’s website to see if they offer you those ETFs. Usually, you get more than one option for specific indices, so take your time to compare the metrics like TER, accumulating/ distributing, and underlying currency. Then finally, choose an ETF for each portfolio slice.

And there it is- the final step: a shopping spree! Buy those ETFs with the allocated amount of money. Again, this is not an exact science: many brokers won’t allow you to buy fractions of ETFs, so round up/down the number of shares accordingly, and try to match the allocation as well as possible.

Where do we go from here?

As with everything in life, investing is a matter of choices. We can build our portfolio once, sit back and enjoy the ride in the investing world. We can regularly add or remove funds according to the allocation percentages.

Or we can review our portfolio regularly and check if the current allocation roughly matches the desired numbers. Usually, it won’t, as different asset classes move with different speeds (and sometimes in different directions)- that’s why we chose to allocate over many different baskets in the first place.

Re-balancing your portfolio

Suppose we want to manage your portfolio actively. In that case, we can restore the original allocation on those regular check-ups: sell assets that grew out of the allocation, buy the ones that lag (or add fresh funds to the latter). This process is called re-balancing. We can do it time-based: once a year, 2x a year, or every three months. Another option (and I prefer this one) would be target-based: we define a range that each portfolio position has to fulfill: for example, for each position in our portfolio, we give a +/- 10% range (or +/- 20% or +/- 25%). In the above´s example, the S&P 500 should be 20% of our portfolio. A +/- 10% range would allow the allocation to move between 18% and 22%. If it gets above, we will sell units to get back to 20% (if below, we buy additional units). The smaller the range, the more frequently we will rebalance.

Final words

No matter what strategy for re-balancing we choose- the more important part is to stick to the plan; we shouldn’t try to outsmart or time the markets by changing the basic allocation every time.

That is it. No secret alchemy, just some basic concepts, (pretty easy) math, and a straightforward process. If you follow this process, it is a good idea to document all steps and results in a spreadsheet- so later you can track your investing train of thought.

If you have additional questions or feedback, please leave a comment or drop a mail to feedback@6xfreedom.com.