Introduction

Imagine you have saved a significant amount of money. You worked hard, saved every spare dollar, and now have a nice sum in your savings account, waiting to be invested. What would be better: invest everything at once, or gradually scale into the financial markets, observing how things develop, and investing bit by bit? We can give both strategies a fancier name: Lump Sum Investing/LSI (invest everything at once) or Dollar Cost Averaging/ DCA (invest fractions regularly).

This article will explain the pros and cons of both strategies (especially their psychological implications) and take a scientific approach to determine which one performs better in terms of pure returns.

For this discussion, we’ll consider DCA as an approach for an already available amount of saved money. If you are continuously saving money and invest it periodically as it becomes available- this is a perfectly valid approach, but not in the scope of Dollar Cost Averaging in this article.

TL; DR: Time in the market is more important than market timing!

What is Dollar Cost Averaging (DCA)?

Dollar Cost Averaging is a strategy where an investor divides the total amount available to be invested into several periodic purchases of an investment. By doing so, the investor reduces the impact of market timing, as each investment is made at different prices according to the current market conditions.

This approach can significantly enhance the psychological comfort of an investor because only a portion of the saved money is invested at a time. Consequently, the burning question, “Is now the right time to buy, or should I wait?” becomes less critical (if you are interested in the psychology part of investing, we recently published an article about cognitive biases in investing). Typically, investments are automated in some way, such as through monthly purchases. A lower price results in a greater number of shares for the same amount, while a higher price benefits the already purchased shares.

However, a potential drawback of Dollar Cost Averaging is transaction fees. Before deciding on this strategy, research how much your broker charges for each investment. While some brokers offer zero-cost monthly saving plans in certain countries, this is not universally applicable. For example, paying $10 for a monthly $100 investment makes little sense. Even a $1 transaction fee would amount to $12 annually, which is 1% of a $100 monthly investment.

To keep you motivated to read the whole article, we will put the question about long-term performance on the back burner for now 🙂

What is Lump Sum Investing?

Lump sum investing is a straightforward concept (yet psychologically hard to execute): we invest a significant amount of money all at once, rather than spreading it out over time.

This eliminates the need for studying the market conditions because we don’t have to make a decision whether now is a good time to invest (or maybe later we can get more shares for the same amount? And aren’t the markets currently too high and due to a correction?). We simply invest the entire amount at once and move on.

At the same time, this is the main challenge of LSI: it is really hard to invest a larger amount of hard-earned money under uncertainty! Especially when the market takes a dive after our investment, it is hard to stomach and bear the loss- even though they are only on paper, until the investment is sold.

A definitive plus is the situation of fees, compared to Dollar Cost Averaging: We only pay once when buying (ok twice- at some point in the future we want to sell with a nice juicy profit).

Historical Performance Analysis 2010 – 2020

I can already see you, dear reader, sliding nervously back and forth on your chair, asking: “Which strategy performs better?”.

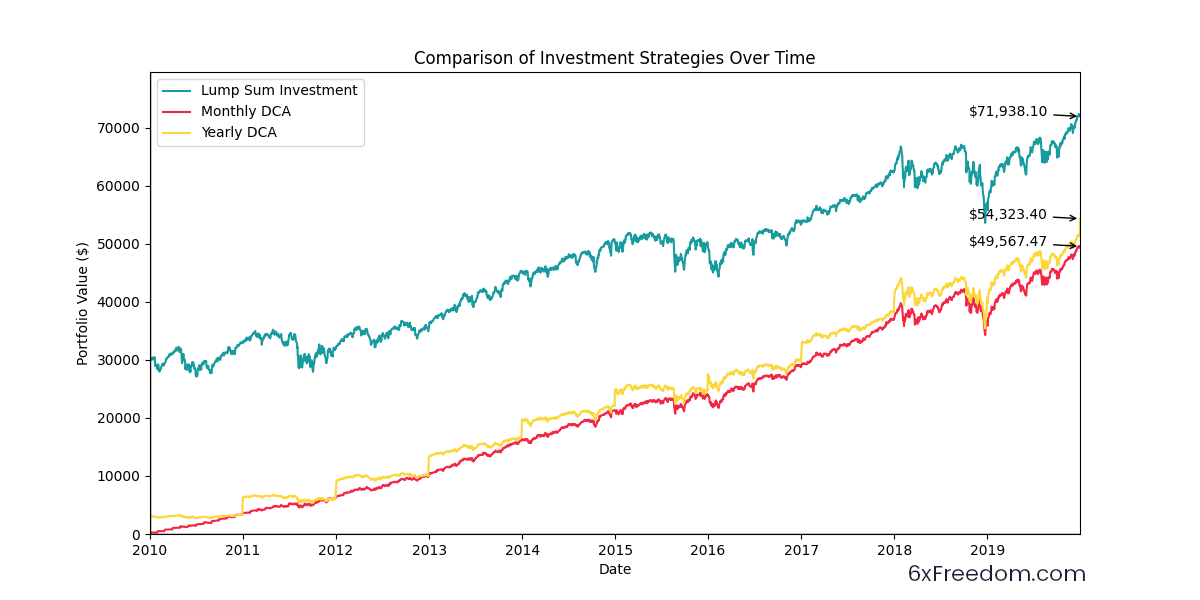

So, let’s do a quick simulation. Here are our assumptions:

- we have a sum of $30.000,- available

- our time horizon is 10 years (from 2010 – 2020)

- we want to invest in the S&P500 (one of the many cheap ETFs out there)

- we consider inflation to get real returns

- we do not consider trading fees

Besides Lump Sum Investing, we consider two flavors of Dollar Cost Averaging: one strategy will invest $3000,- each year, and the second one will invest $250 every single month.

As we can clearly see, LSI outperformed DCA in the chosen timeframe by a large margin. Also, we can see that both DCA strategies smoothed out the return curve for the first couple of years, as we were slowly building our investments. Later, when we were more invested, the return curve became equally choppy as in the LSI strategy. This is logical: for the first couple of years (in this example six), the fluctuations in the portfolio were smaller than the periodic additions by new investments.

The other side of this coin is also clear: we missed a lot of growth simply because we were not fully invested yet (look at the years 2012 – 2015). In other words: time in the market beats market timing! This graph is the perfect visualization of the trade-off between risk and return in the two strategies.

Performance 1960 – 2024 with random starting points

There is one major criticism of the previous methodology: it analyzed only a single scenario, which might have favored one strategy over the other due to the chosen timeframe. How can we mitigate this concern?

We’ll use a scientific method called “Monte Carlo Simulation”. By using historical data from a longer period and choosing random starting points, we can perform both strategies over different periods. We do this many times to determine if the performance differences are dependent on the starting point or not.

Again, here are our assumptions:

- use data from 1960 – 2024 and choose a random start date within that period

- again invest in the S&P500

- we have a sum of $20.000,- available

- each simulation run covers 10 years

- for DCA strategies, the whole amount is invested over the first five years (so $4.000/ yearly and $333/ monthly), the remaining five years being passive

- we perform this simulation 1,000 times

- we do not consider trading fees

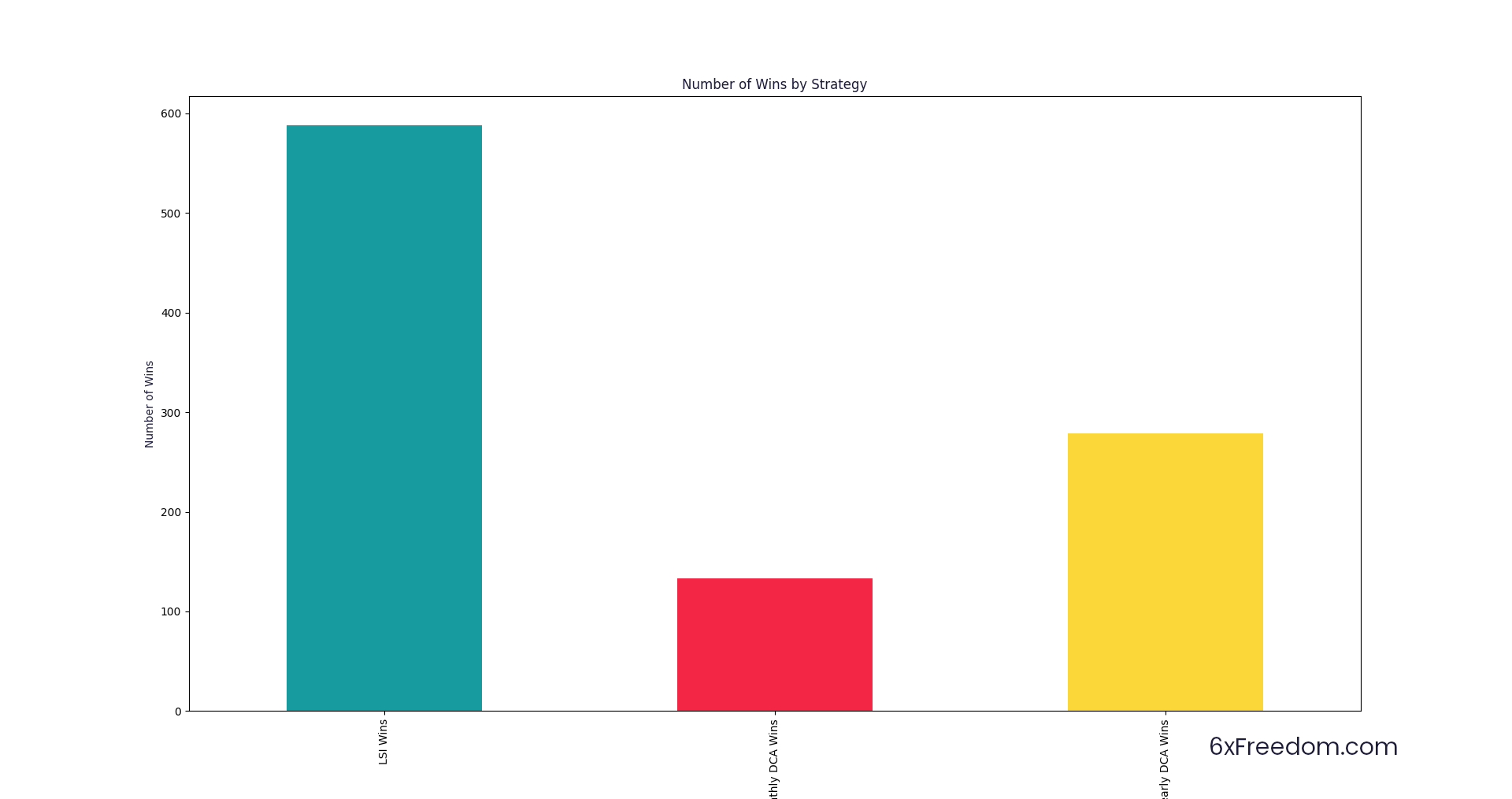

The results are clear. Let´s start with an easy bar chart. After running the scenario 1,000 times, we get the following results for the strategy win counts:

LSI Wins: 588

Monthly DCA Wins: 133

Yearly DCA Wins: 279

So, Lump Sum Investing performed better. But how much better? Let’s look at some statistics:

Best Performance for lsi_final_value: Start Date: 1989, End Sum: $65832.75

Worst Performance for lsi_final_value: Start Date: 1969, End Sum: $9781.87

Best Performance for dca_monthly_final_value: Start Date: 1990, End Sum: $60130.70

Worst Performance for dca_monthly_final_value: Start Date: 1965, End Sum: $9693.10

Best Performance for dca_yearly_final_value: Start Date: 1990, End Sum: $59332.21

Worst Performance for dca_yearly_final_value: Start Date: 1965, End Sum: $9815.50

So the upper outliers favor LSI, with significantly higher peaks than than both DCA strategies. The worst scenarios for all three strategies are roughly in the same ballpark. If you are interested, you can have a look at a historic S&P500 chart to visualize those periods.

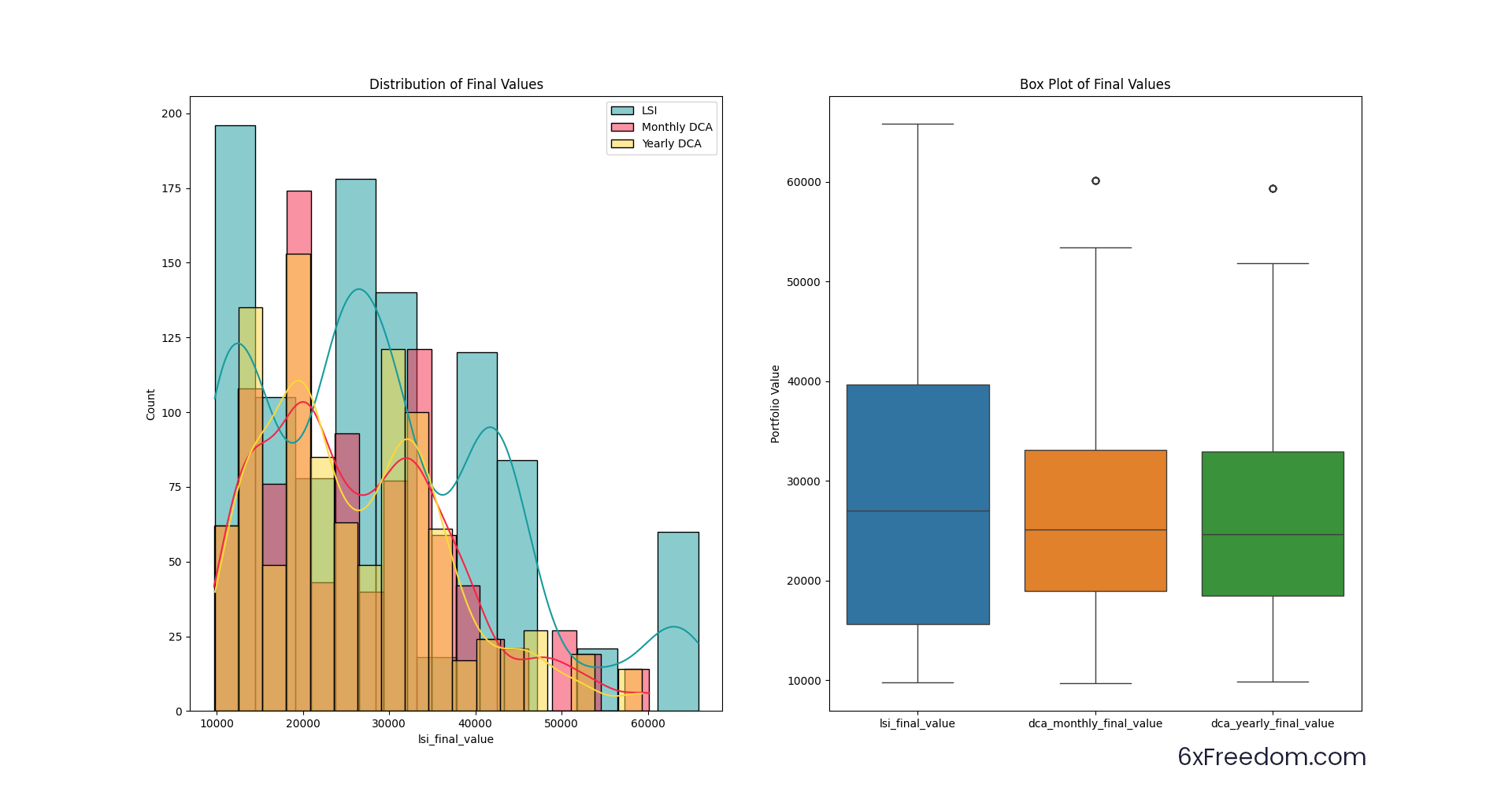

With data from 1,000 separate simulation runs, we can do even more statistics and visualization to dig deeper into the strategies. Look at these charts:

The right plot shows us the “interquartile range” of each strategy´s result. That’s a fancy expression for where the bulk of the results lie and how they are clustered around the center.

Lump Sum Investing

- interquartile range (25th to 75th percentile a.k.a. “the bulk of the results”) is between approximately $16,000 and $40,000, with a median value of around $27,000

- some outliers above $60,000 indicate some simulation runs resulted in significantly higher values (see the “best performance” statistics above)

- on the downside, some scenarios resulted in $10,000 (which translates into a 50% loss of the invested money after 10 years)

Monthly Dollar Cost Averaging

- interquartile range is roughly between $20,000 and $34,000, the median being around $25,000

- some outliers to the upside, however, they are smaller (around $53,000) when compared to LSI

- downside scenarios are around $10,000, similar to LSI (looks like the mid- to the late sixties were not the best environment to start investing)

Yearly Dollar Cost Averaging

- similar characteristics to monthly DCA.

Let’s shift our attention to the beauty on the left side of that picture: a histogram with density curves of the distribution of each strategy´s result. The X-axis shows the final portfolio value, and the Y-axis measures the count of simulation runs resulting in this portfolio value (if you sum up the results for each box color, you get 1,000: the total number of simulation runs). The density curve smooths out the histogram boxes, allowing us to see the peaks in the data more clearly.

As we can see, LSI strategy scenarios had several peaks:

- at around $11,000

- at around $27,000

- at around $40,000 and

- a smaller one at around $63,000

Both DCA variations look similar to each other and show peaks

- at around $20,000 and

- at around $32,000

The statistics confirm that there are significant differences in performance between Lump Sum Investing and Dollar Cost Averaging strategies.

Lump Sum Investing showed higher potential returns but also came with higher variability and risk.

Dollar Cost Averaging strategies (both Monthly and Yearly) provided more consistent outcomes but with generally lower returns compared to LSI.

Comparing both DCA strategies, Yearly DCA offered slightly better outcomes compared to Monthly DCA, but both were still generally lower than LSI. If trading fees have to be considered, I would recommend going with the yearly strategy.

This analysis suggests that investors with a higher risk tolerance and a preference for potentially higher returns should go for LSI, while those seeking more consistent outcomes might prefer DCA. Yearly DCA, while still providing decent returns, shows more variability and may be less predictable.

Further reading

As always: Do your own research! As registered members will get access to the source code that was used to create the analysis and graphs in this article, we strongly encourage looking for other sources on this topic as well. As a starting point, we give you three papers from some renowned sources:

“Dollar-cost averaging just means taking risk later” (Vanguard, 2012):

https://static.twentyoverten.com/5980d16bbfb1c93238ad9c24/rJpQmY8o7/Dollar-Cost-Averaging-Just-Means-Taking-Risk-Later-Vanguard.pdf

“The fundamental problem with DCA is that it is a market-timing strategy.” (Morningstar 2019):

https://www.morningstar.ca/ca/news/197440/dollar-cost-averaging-vs-lump-sum-investing.aspx

“depending on an investor’s level of risk aversion, dollar-cost averaging can be an optimal investment strategy” (Journal of Financial Planning, 2015)

This concludes our article about Lump Sum Investing vs. Dollar Cost Averaging. We hope you liked the more scientific approach!

If you have additional questions or feedback, please leave a comment or drop a mail to feedback@6xfreedom.com