This article kicks off a three-part mini-series about the ecosystem of financial markets. We will explain the participants, their roles, and their interactions. And we will have a look at our place in this ecosystem: us, being the retail investors.

This first article will explain the difference between primary and secondary markets. The difference is essential, as the flow of money and securities differ fundamentally. To know how and where securities are created, how and where they are traded and

In the second article, we will closely examine the primary market. We will introduce the concept of “buy-side” and “sell-side”, highlight the role of Investment Banking in primary markets and look at who are the investors in the primary market.

Why is this important?

Well, we think that before going hunting, we have to know something about the ecosystem we are part of. And, spoiler alert: unlike out in the wild, humans as retail investors are not the apex predators. Far from that, it´s better to know which areas are safe to go and where the big tyrannosauruses are hunting…

For this introductory article, let’s start with some definitions to have a standard dictionary.

A Common Dictionary

Markets

Markets, in the sense of “financial markets,” are mechanisms/ facilities where parties can exchange securities. A couple of things constitute a financial market:

- Buyers

- Sellers

- Securities

- Place (physical or non-physical, like online)

Markets have the function of determining a market price for securities and bringing as many buyers and sellers together as possible.

Securities

Securities are traded on financial markets. Securities are fungible, which means each unit is interchangeable with another unit of the same security; they have the same properties. Securities have a monetary value that is determined by the markets.

Securities fall into three broad categories:

- Equities

- Debt

- Derivatives

Equities

Equities are just a fancy name for stock shares. Holders of stock shares are in fractional ownership of the company that issued those shares.

Debt

Debt securities (better known as bonds) are instruments where investors lend money to another party. Those parties can be governments, corporations, or other organizations. The debt is coupled with an interest rate and a maturity date (where the debt has to be paid back). Because of the regular interest payments, this type of security is also known as fixed income.

Derivatives

Derivative securities are neither equities nor debt. Instead, this type of security is constructed by an underlying asset’s price movement (equities, bonds, or commodities). Derivatives can but don’t have to be leveraged compared to the underlying. Examples of derivatives are options, futures, certificates, and Contracts for Difference (CFDs).

Primary Market

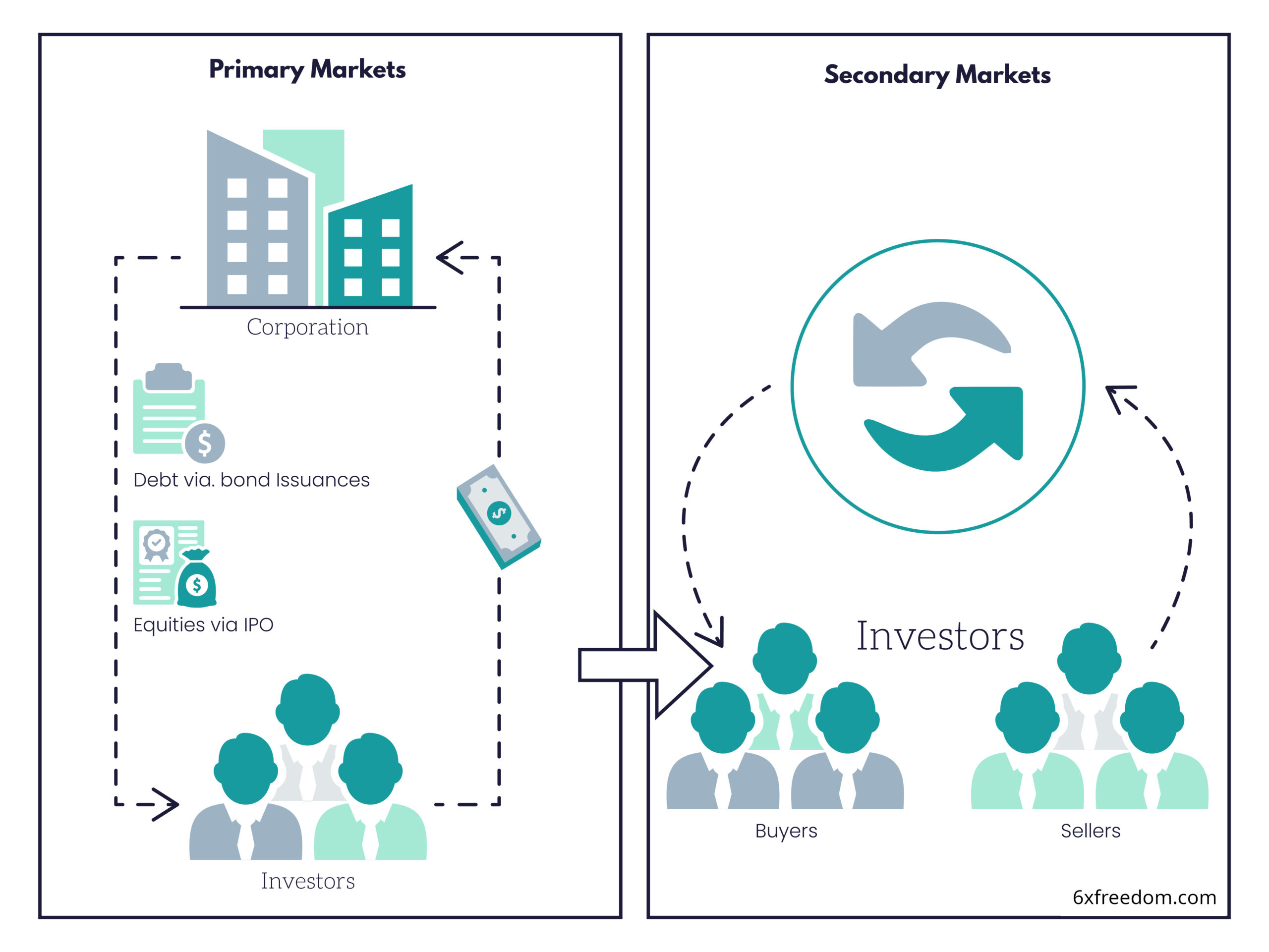

Please have a look at the left side of the illustration above. The primary market is a market that acts as the source for new securities. Organizations (like governments or companies) collect money from investors and give securities in exchange. In the follow-up to this article, we will cover the primary market in depth.

Secondary Market

Now please look at the right side of the illustration. In secondary markets, investors interact directly with each other to buy and sell securities. All traded securities were created on the primary market before; the secondary market does not create new securities.

Primary vs. Secondary Market

To summarise: Primary Markets are where securities are created and sold. Once those securities exist, the holders can trade them on secondary markets.

While the primary market is a market between issuers of securities (e.g., governments or corporations), the secondary market is between investors who want to buy and sell those already issued securities.

For retail investors, the secondary market usually is the more interesting one. While they can take part in Initial Public Offerings (IPO- when a company for the first time offers shares to the public) or Bond issuances, primary markets are dominated by institutional investors like Pension Funds, Banks, and Insurance companies.

It is essential to understand that corporations only get money from investors in the primary market. Every time their shares are later traded on the secondary market, the corporation does not profit from that exchange (with the obvious exception that the company sells their own shares- in this role, they act like an investor on the secondary market).

The following articles will dive deeply into the Primary and Secondary Markets.

If you have additional questions or feedback, please leave a comment or drop a mail to feedback@6xfreedom.com