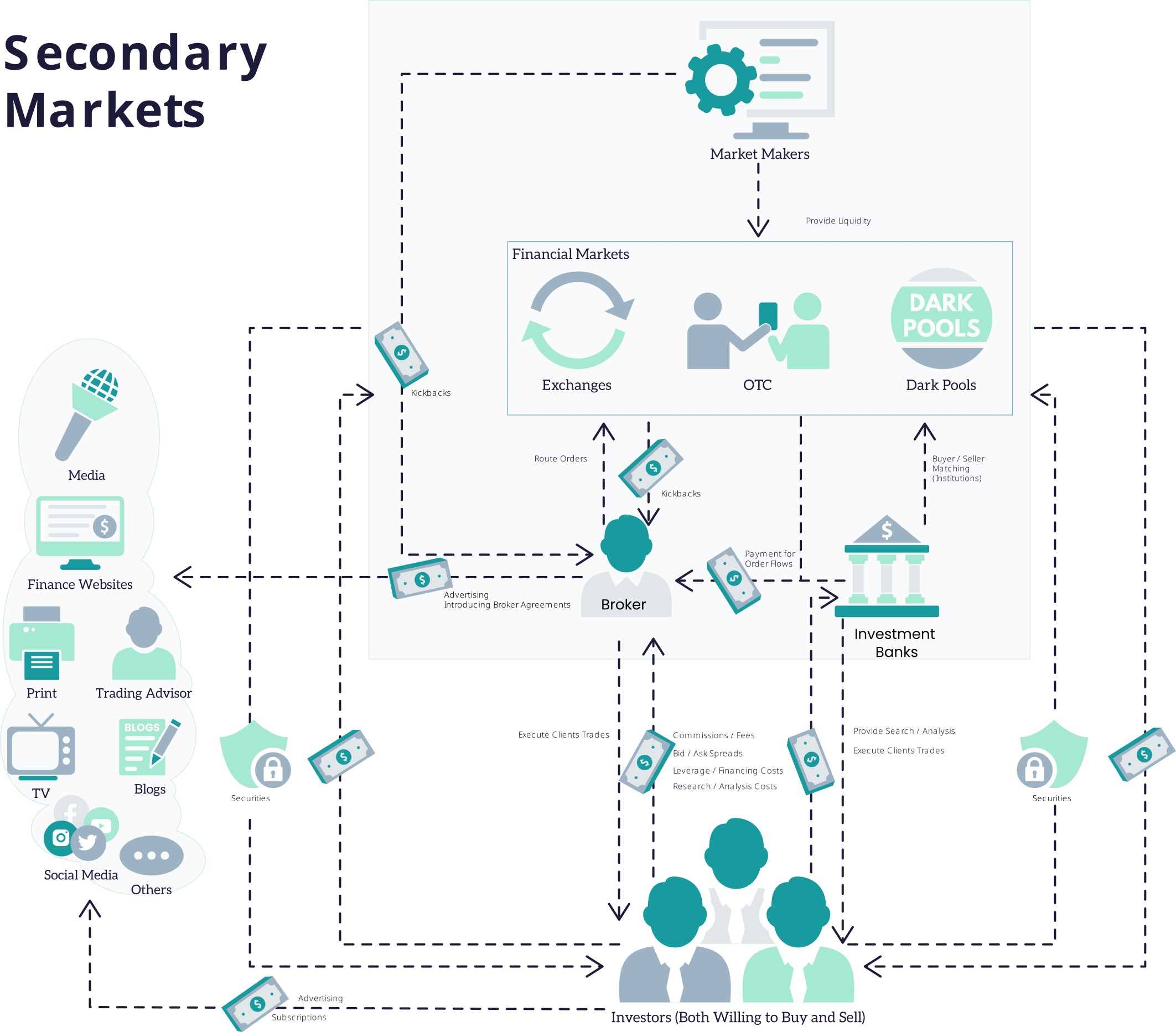

This article will explain the mechanics and participants of the secondary market. The secondary market is where existing securities are traded between investors.

For a quick overview, you can check the learn how markets work article; if you’d like to know more about Primary Markets, please read this.

Introduction

The securities traded on the secondary market were issued and sold for the first time in the primary market. It’s the secondary market that allows transactions between investors- without interaction with the issuers. Unlike the primary market, the price determination of the securities is not influenced by the issuers. The fundamental market mechanism ruled by the supply and demand dynamics determines the price.

Different types of secondary markets

This article looks at three types of secondary markets: exchanges, over-the-counter (OTC) markets, and Dark Pools. All types can come in different flavors; their main difference is that exchanges are centralized, transparent, and regulated, while OTC and Dark Pools are decentralized and less regulated- resulting in less transparency.

Exchanges

Exchanges can be physical or electronic centralized marketplaces. Exchanges trade listed securities that have to fulfill strict criteria.

Investors in Buyer and Seller roles interact with each other via intermediaries. These intermediaries, called brokers, must be registered and licensed at those exchanges. All transactions are recorded all information is publicly available.

On an exchange, the price determination is centralized as well. If you are interested in an in-depth explanation of how prices in secondary markets (like stock exchanges) are determined, follow this link.

Examples of Exchanges are The New York Stock Exchange, NASDAQ, and the Chicago Mercantile Exchange.

Over the counter (OTC)

On the other hand, OTC Markets are decentralized and without a physical location. Investors can trade unlisted securities directly with each other without a central exchange/ price determination mechanism. Unlisted securities mean less transparency because there are fewer regulations and requirements for sharing financial information from the companies traded.

As there is no central price determination mechanism, OTC trading relies on Market Makers that provide market liquidity.

As a rule of thumb, OTC markets are riskier than exchanges.

Dark Pools

Dark Pools are another alternative to regulated exchanges. Dark Pools allow institutional investors to buy and sell high-volume orders. Operated by companies (for example, investment banks), Dark Pools allow large orders without affecting the price (as would happen when executed on an exchange). Another advantage is that the buying/selling does not become public knowledge until the trade gets executed and reported (also in contrary to exchanges).

The importance of Dark Pools has risen steadily and significantly over the last 10-15 years. They are available for institutional investors only and are not accessible to retail traders. Large-volume trading without affecting the price might sound like a good thing. But this also opens the door to many new problems.

While on an exchange, an accumulation or a large-scale dump of securities gets noted by the public very soon, dark pools hide institutional investors’ activity from other participants- including financial media and retail investors. Trends become less reliable when a significant fraction of traded volume is executed off-grid.

Participants in secondary markets

Let’s have a look at the participants in secondary markets. We can differentiate into institutional investors and retail investors. Unlike in primary markets, investors appear as buyers and sellers in the secondary market, exchanging money for securities and vice versa.

Investors

Institutional Investors handle other people´s money. They are companies or organizations that operate in many different forms in the financial markets. To name a couple of examples: Pension Funds, Mutual Funds, issuers of ETF, Insurance companies, and banks.

Retail Investors, on the other hand, invest their own money in their accounts.

Exchanges allow institutional and retail traders to interact with each other.

Investors generally have to pay to participate in the markets: they pay for commissions, trading fees, and the spread (the difference between Bid/Ask quotes- we`ll explain that deeper when we talk about Market Makers). Also, investors pay for information. Usually, institutional investors have access to high-quality professional research and financial information, but these services have a price tag. Retail traders, on the other hand, also pay for trading advice. Usually, lower quality financial information/data- that, on the other hand, is very cheap compared to the professional research mentioned before.

Brokers

Investors usually do not participate directly in markets. Especially exchanges are rigorous concerning access to their systems- so investors act through intermediaries, so-called brokers. Brokers must be licensed and registered at the exchanges, take their client’s orders, and route them to the exchanges. Brokers can be people and automated systems, especially in today´s world of automation.

Brokers collect fees from their clients- and at the same time, get kickbacks from exchanges for bringing market participants and liquidity to them. This is a source for conflicts of interest, as brokers get incentivized to bring as many clients to the exchange as possible. Brokers are getting paid when their clients win and when they lose. They collect fees and get kickbacks from exchanges. Think about it, when you see the next shiny advertisement from your broker that tries to push you to trade more.

Another aspect that gained importance over the last couple of years is brokers’ business model, especially retail brokers. In the retail world, we saw the rise of so-called neo-brokers, offering very cheap or even free accounts- and very cheap or even free trading fees. How is that possible, given that we said brokers live primarily from fees? There are multiple ways a retail broker can still earn money without directly charging you for trading.

One option is to also act as Market Maker. The broker sees all clients’ orders, both willing to sell and to buy. So the broker can match those orders, collect the bid/ask spread, and route only the remaining orders to the exchange.

Another option is the so-called “payment for order flows.” The broker sells the cumulated orders of his clients to other market participants, for example, investment banks. With the positioning of retail traders in mind, investment banks can adjust their actions to maximize profits.

In both cases, brokers act against their clients, two more textbook examples of conflicts of interest.

Investment Banks in secondary markets

We already learned about the role of Investment banks in the article about primary markets. In secondary markets, investment banks also play more than one role. On the one hand, they provide access to Exchanges, OTC markets, and Dark Pools and even offer asset management for institutional investors.

On the other hand, like in primary markets, the research departments of investment banks offer research and analysis to their clients. Generally, the higher the quality of the provided information, the more expensive it is. Be careful about the free information provided in financial media- usually, the dissemination of free information also serves a purpose. But, likely, the goal is not to make retail investors rich.

Market Makers

We already mentioned Market Makers in the section about investors. In markets, trades occur only if enough buyers and sellers agree on a trading price and have enough securities to satisfy all buyers and sellers. This concept is called liquidity. The more liquidity, the smoother the price action (the less liquidity- the more significant the price jumps).

Market Makers now offer securities and buy securities to/from other participants. They are not looking for returns of the securities (or dividends) but live from the so-called spread. This is the difference between the Bid- and Ask-quotes. By buying securities for one price and immediately selling them for a (slightly) higher price to someone else, they provide liquidity- and a steady stream of income into their own pockets.

The role of Media in secondary markets

Finally, we have omnipresent yet indirect participants in the financial markets: the media. Finance media is not a direct participant in the markets in the sense of having a role in the buying/selling mechanisms.

However, the information they provide is omnipresent and influences most of the actions of the other participants. At the same time, the media is also used as a tool by market participants who try to influence each other.

Finance media comes in many formats and channels: print media, TV shows, finance websites, blogs, trading advisers, and social media, to name a few.

Retail Investors pay a lot for subscriptions, trading advice, financial data, etc. Almost every other participant pays for advertisement- the main target being us Retail Investors again. While blinking ads might be annoying, they are most easily recognizable.

A problem arises with the more subtle forms of manipulation. For example, many trading advisers/financial service sites have hidden “Introducing Broker Agreements”: they push Retail Investors to trade with certain brokers, to trade with high frequencies, and to trade a lot. All the while, brokers are getting kickbacks from that brokers. It’s the textbook example of a conflict of interest.

Another problem is the sheer amount of available information. Finding high-quality, unbiased research is hard to find- and almost impossible to get that for free. Which, of course, makes sense: if you are a participant in the market and want to nudge public opinion into a direction that is good for your investments- you want as many people as possible to read that.

So you provide this information for free. Countless finance media websites and blogs will happily pick this up and publish it- (mostly retail) investors will act based on these biased bits of information.

And almost every non-retail participant in the markets pays for advertisements in finance media- so finance media has an incentive for good relations and noncritical publicity.

This is not to say there are no high-quality finance media- one has to pay for that. The signal-to-noise ratio is, unfortunately, abysmal when looking for freely available information.

Interactions in secondary markets

Now that we looked at the major players in the markets let’s have a closer look at how they interact and how everybody tries to make money in the process.

Virtually everybody (except retail investors) pays for media advertisements to attract more customers to their products and services. Investors also pay finance media sources for investment-related information and research. In the case of institutional investors, investment banks also provide these services.

To get access to the markets, investors task brokers or investment banks (in the case of large institutional investors) to route their orders to the markets- for a fee, of course. Some retail brokers systematically sell their clients’ bundled orders to other market participants.

Brokers eventually get kickbacks from the companies operating financial markets to bring liquidity and users. Exchange fees are usually paid by the investors, as well. Usually, there is a price difference between the bid and ask prices- also paid by the investors. This is the primary source of income for Market Makers.

Summary

This article explained secondary markets from the ground up. We covered the basics, the main participants, roles, and interactions.

We saw who earns money with what- and that the whole system is designed to make the end user (in this case: the retail investors) pay for everything.

Also, the impact of finance media can not be overstated: all participants place their advertisements to influence us, and the media depends on this income. So the quality of free information varies greatly: low signal-to-noise ratio is the norm, not the exception.

This article is not meant to scare anybody or feed a “the whole system is rigged”-narrative. This is nonsense. The system is what the system is. But if we want to be part of this ecosystem, we must know its rules and players.

If you have additional questions or feedback, please leave a comment or drop a mail to feedback@6xfreedom.com