Let’s develop a process that leads us into investing! We will break it down into five easy, actionable steps how to start investing now.

If you landed on this site while looking at how to start your journey as an investor: congratulations, you took the necessary first step! In the beginning, the whole topic and its complexity may be intimidating.

The available information is overwhelming, confusing, and unsuitable for beginners and retail investors. This article tries to change that: let us help you by paving a way through this jungle.

Why you should be investing

Compound interest

The basic idea of investing is to put our hard-earned money to work. Albert Einstein called compound interest the “Eighth wonder of the world. By not pulling out the interest we get every year but instead adding it to our “money workforce,” we can consistently build wealth over time.

If we assume an amount of $10.000 and get 1% interest on that amount for ten years, we end up with $11.046. With a higher rate of return, say 3%, we end up with $13.439. 5% lead to $16.289, 8% even to $21.589- a doubling after ten years!

Risk and reward in investing lead to higher returns

Cash allows us to earn interest in a bank account- at the time of writing this article (end of 2022), the interest on this money is way lower than inflation. We lose money monthly if we keep it in a bank account!

In contrast to adding excess money to an evergrowing pile of cash, investing allows us to participate in a risk/chance type mechanism: higher risk in investments leads to higher possible rewards.

This, of course, includes the dreaded drawdowns in our portfolios. But, historically, financial markets allowed investors to get higher returns on their investments than are possible with interest at bank accounts.

No shortcut to wealth

We must be aware of the daily advertisements faced by the financial industry and millions of advisors: there is no shortcut to wealth. Compounding and building wealth is a continuous process that takes time. The first $10.000/ $100.000/ $1.000.000 are always the hardest!

So when is the best time to invest? The answer is simple: now! It is never too early nor too late, so start investing. Let’s look at the prerequisites we have to meet to begin.

Prerequisites

Excess money

First of all, we need to have some excess money. Money that is not required to pay the monthly bills and cover our basic needs. Even better if we have an income that allows us to put aside extra money regularly.

Ideally, we also saved some money for instant-access “Emergency Funds,” which allows us to continue to pay for the bills for 3-6 months in case of any kinds of emergencies, like Job loss, accidents, health issues, and such.

Settle debts

We should have paid all our debts. This is important. Before even thinking about investing, we should settle all existing debts. Debt interests are locked and, in many cases, higher than the volatile returns we can achieve by investments. From a risk-management perspective, paying off the debt and then investing is better.

An extension of this thought: Do NOT invest with borrowed money! Bad luck and lousy timing will bring you into the devil’s kitchen, and you might end up with debt instead of returns. Invest only with money you have and are willing to put it at risk.

With that being said, let’s start with the investment process!

Step 1: Learn the basics, make educated decisions

Good news: you started step 1 by researching investing and reading this article! When starting, the amount of available information and the topics/concepts we are confronted with might be overwhelming, even intimidating. And as is valid with every field, learning about financial markets is a process that never finishes. Every door we open leads to a new room with more doors.

It is not unlikely that our first question as a beginner is something like “What stocks should I buy?”. This is the wrong question at this point- but we will pick it up later.

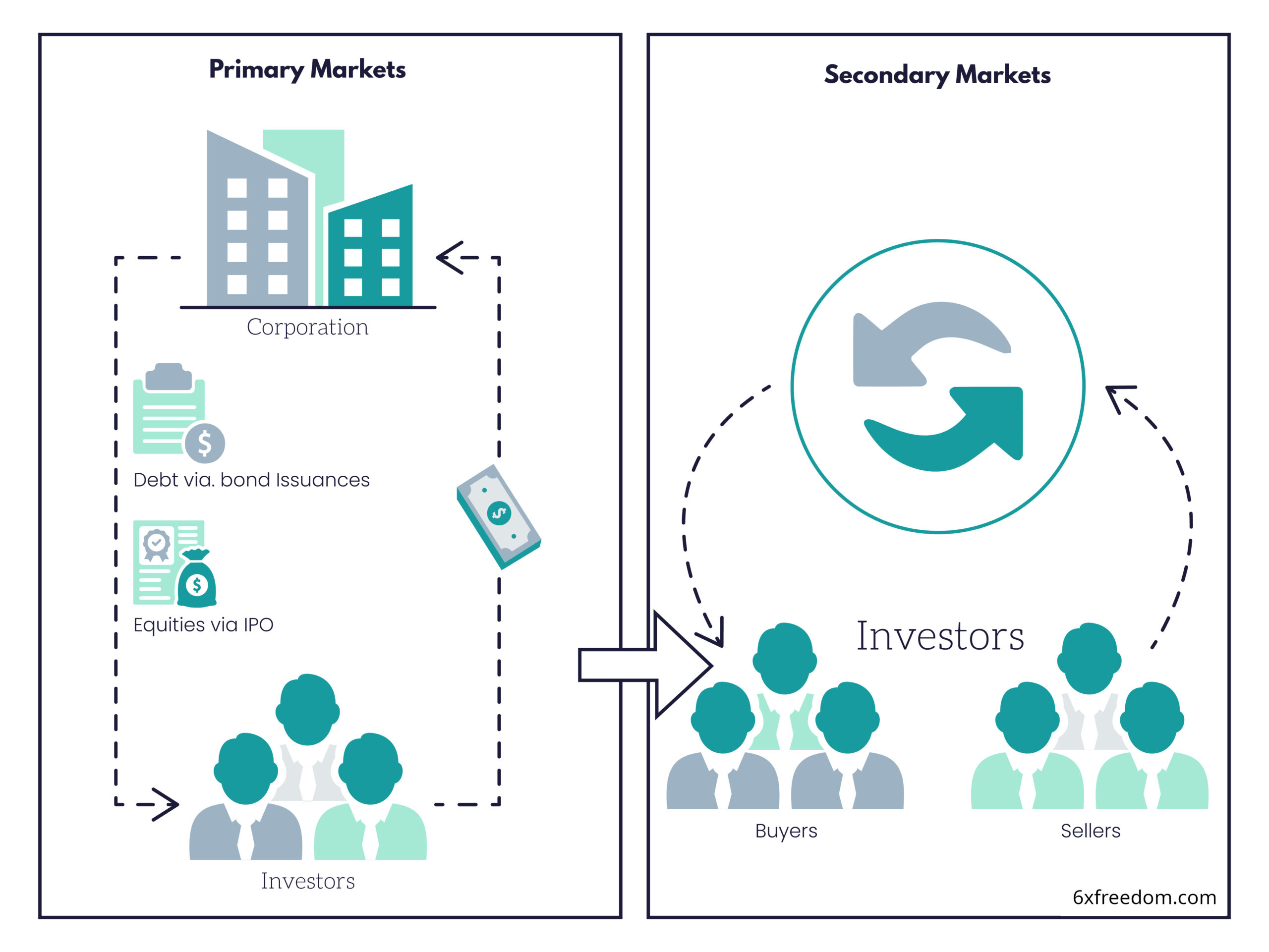

Now it is time to learn some basics about the financial markets. Think of them as an ecosystem we have to get familiar with. Who are the players in this ecosystem, how do they interact, and in which niche are we retail investors? A starting point could be our articles about how markets work:

Part 1: How markets work; Part 2: The primary market and Part 3: Secondary markets.

Also, reading about different investing styles and methodologies is a good idea before actually going out and buying “something.”

Don’t be fooled by “get rich quick” offers that pretend to make you a millionaire in a short time- as we said above, compounding wealth is a process that takes time.

Step 2: Get a broker account.

If we have already started step one, we should know what a broker is and why we need one to start investing. So let’s do some research about the available options. We check online about brokers available in our country and if their customers are satisfied with the service. The following paragraphs give some additional starting points for our research.

Costs

What is the cost structure of the broker? Do we pay a monthly or yearly fee? Are those fees paid by transaction?

Of course, in general, “the cheaper, the better,”- but the warning bells should ring if a broker’s service is very cheap or even free: brokers have to earn money, too. If they don’t get the money from us, their customers- chances are very likely that we are the product.

This means that there are hidden costs, and most likely, our data (not only about personal data but also about our transactions) is sold to other players in the financial markets.

Accessibility

What channels are provided by the broker to access our portfolios? The most common ones are via a smartphone app and web-based. Ideally, both are offered. Is there a telephone hotline in case we have a problem and need a human to talk to? 99% of the time, we won’t need that option. It is the 1% that matters, and we should consider if this safety net is worth paying for service costs money.

Usability

How are the user interface and the presentation of the portfolio? Is it clear and understandable? Are the relevant metrics all available (Profit/loss, date of buying, the value of each position, performance for different lookback periods, aggregated numbers for portfolio, and so on)? How can we buy and/or sell instruments?

Markets and instruments

Does the broker offer us access to different exchanges? It is common for the usually very low-fee neo-brokers to be tied to specific exchanges- usually less liquid than the bigger ones. Again, a more comprehensive selection traditionally comes at a higher cost.

Also, we should compare the number of instruments between different brokers. Look for the number of ETFs, stocks, and bonds that are tradable with each one. The more, the better.

If we want to invest regularly, we should check if the broker offers saving plans and, if so, at which costs.

If we finally have settled with a broker we are comfortable with; we should open an account (this may take a couple of business days for the verification process) and familiarize ourselves with the website/ user interface. Beware: we won’t start buying or selling yet 🙂

Step 3: Choose a strategy

Now it is the time for strategizing! As mentioned in the introduction, we already have a three-article series online, that details how to create a strategy tailored to our needs.

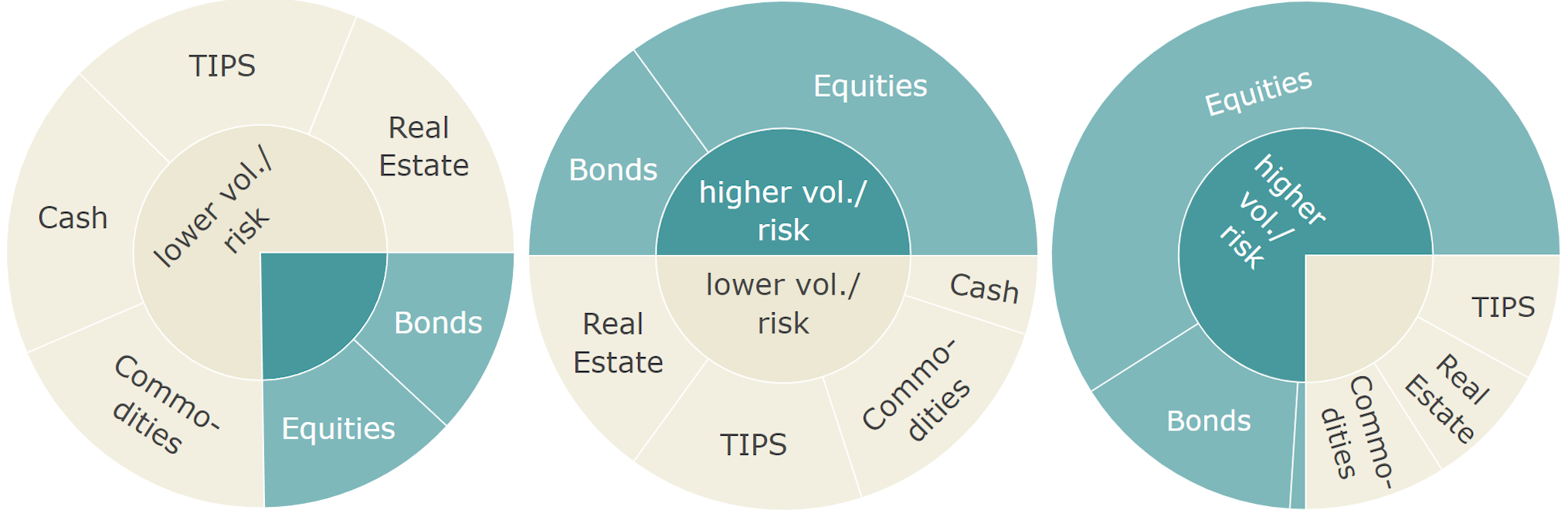

In the first article, we talk about diversification– the one free lunch in investing. The second article gives some insights into portfolio construction and asset allocation, while the third and final article covers howto translate from asset classes to actual securities and determine the amount of money for each security.

In a nutshell, we should choose a risk profile for us, determine an allocation of asset classes for this risk profile and choose suitable instruments for this allocation (offered by our preferred broker).

Then, based on the amount of money we are willing to invest, we calculate how many units of each instrument we buy.

Step 4: Start investing: Buy securities!

Now comes the shopping spree! After finishing step three, we have a plan- now we execute this plan. We buy the selected securities in the calculated quantities. If we went for periodical investments, we set up the saving plans at our broker- also using the allocation we determined prior.

A couple of thoughts about market timing: it doesn’t work. Simple as that. But this does not matter. In a diversified portfolio, some instruments will be more expensive (compared to their past), and some will be cheaper.

As long as you don’t have an absolute metric of “too expensive” or “correctly priced,” it makes no sense to wait for instrument prices to reach your desired levels. Doing so is more active trading- which is not the subject of this introductory article. As we initially said, the best time to invest is NOW.

Step 5: Rinse and Repeat

We did it! We now have skin in the game and are investors! Let´s lean back, have a beer (or tea/coffee/water/whatever), and review our portfolio regularly.

By doing so, we will learn a lot about ourselves: as the numbers for our portfolio change daily, some will go green, and some will go red. We might get nervous, feel anxious, or feel like the most competent person on Earth. We will experience the nuances of the psychology of investing!

As this topic is worth an article on its own, we won’t go deeper now; just one hint: the human brain is wired to give losses far more weight than gains. We must stick to our plan, evaluate it regularly, and adapt if necessary.

As we continue on our investing journey, we will continue learning, get more tools in our tool chest and expand our strategy.

Also, we must continue to transfer excess money to our investments- being an investor is a process, not a fixed state!

If you have additional questions or feedback, please leave a comment or drop a mail to feedback@6xfreedom.com